The data we collect – and ways to manage your privacy.

Every company needs to have a transparent data policy. We’ve outlined ours in easy-to-understand terms and show you exactly what we do and do not do with regard to sharing information. We also make it easy for you to make adjustments to your privacy settings where applicable. Your privacy is important. Make sure you know how best to safeguard it, just as we do our part to protect information you’ve shared with us.

- Home Banking Terms & Conditions

-

Privacy Policy

-

Website Privacy Policy

Website Privacy Policy

DoverPhila's Home Banking (Internet Banking) Terms & Conditions

DoverPhila Federal Credit Union (“Credit Union”) requires that all visitors to our website (the “Site”) adhere to the following terms and conditions. Accessing the site or viewing any of its content shall constitute your acknowledgement of and agreement with these terms and conditions. If you do not agree, please exit the Site at this time.

Website Content/Use of Information and Materials

This website has been established by the Credit Union for the sole purpose of conveying information about the Credit Union’s products and services and to allow communication between the Credit Union and its members. Information that appears on this website should be considered an advertisement. Nothing contained in any page on this Site takes the place of the Credit Union’s agreements and disclosures that govern its products and services. If any information on the Site conflicts with that in the Credit Union’s agreements and disclosures, the agreements and disclosures will control. Your eligibility for particular products and services is subject to our final determination and approval. The information and material contained on the Site and this agreement may be changed from time to time by posting the new Terms & Conditions on the website.

All users agree to be subject to this agreement as it changes from time to time.

Copyright/Trademarks

All information, including designs, content and images, contained on the Site is owned by DoverPhila Federal Credit Union or CUconnections and/or licensed to DoverPhila Federal Credit Union or CUconnections. All information and content including software programs available on or used to operate the Site (“Content”) is proprietary to the respective owners. Users are prohibited from modifying, copying, distributing, transmitting, displaying, publishing, selling, licensing, creating derivative works or using any of the Marks or Content available on or through the Site for commercial or public purposes.

No Warranties

The Credit Union makes no warranties of any kind regarding the products and services advertised on this Site. The Credit Union will use reasonable efforts to ensure that all information displayed is accurate; however, the Credit Union expressly disclaims any representation and warranty, express and implied, including, without limitation, warranties of merchantability, fitness for a particular purpose, suitability, and the ability to use the Site without contracting a computer virus. The Credit Union is not responsible for any loss, damage, expense, or penalty (either in tort, contract, or otherwise), including direct, indirect, consequential, and incidental damages, that result from the access of or use of this Site. This limitation includes, but is not limited to the omission of information, the failure of equipment, the delay or inability to receive or transmit information, the delay or inability to print information, the transmission of any computer virus, or the transmission of any other malicious or disabling code or procedure. This limitation applies even if the Credit Union has been informed of the possibility of such loss or damage.

Card Management

The card management feature is offered by DPFCU (referred to herein as “CardHub”, “us”, “we” or “our”) for use by DPFCU cardholders. DPFCU ’s card management feature is intended to allow You to initiate certain payment card related activities for Your enrolled DPFCU card(s) via the card management feature. Those activities may include the ability to but not limited to:

- Register the card

- Activate and deactivate the card

- Set control preferences for card usage including location, transaction, and merchant types, spend limits, and card on/off (“Controls”)

- Set alert preferences for card usage including location, transaction, and merchant types, spend limits, and declined purchases (“Alerts”)

- View transaction history including cleansed and enriched merchant information (e.g., merchant name, address, and contact information)

- Report Your card as lost or stolen

- Review Your spending by merchant type and/or by month

- View a list of merchants storing Your card information for recurring or card-on-file payments

The card management feature may enable access to DPFCU and third parties’ services and web sites, including GPS locator websites, such as Google. Use of such services may require internet access and that You accept additional terms and conditions applicable thereto, including, with respect to Google maps, those terms and conditions of use found at http://maps.google.com/help/terms_maps. Html and the Google Legal Notices found at https://www.google.com/help/legalnotices_maps/, or such other URLs as may be updated by Google. To the extent the card management feature allows You to access third party services, DPFCU and those third parties, as applicable, reserve the right to change, suspend, remove, limit, or disable access to any of those services at any time without notice and without liability to You.

You agree to allow us to communicate with You via push notification, SMS and/or email, with respect to the activities performed via the card management feature. Data fees may be imposed by Your mobile provider for the transmission and receipt of messages and Alerts.

DPFCU reserves the right to send administrative and service notifications via emails and/or SMS messages to the email address and/or phone number provided upon enrollment in DPFCU’s card management feature.

Availability/Interruption. You acknowledge that the actual time between occurrence of an event (“Event”) triggering a selected Control or Alert and the time the notification of such event is sent to Your mobile device (“Notification”) is dependent on a number of factors including, without limitation, Your wireless service and coverage within the area in which You are located at that time. You acknowledge that Notifications of Events may be delayed, experience delivery failures, or face other transmission problems. Similarly, selection of Controls and Alerts (collectively, “Commands”) are likewise affected by the same or similar factors and problems could arise with use of Commands. Notifications of Events may not be available to be sent to Your mobile device in all areas.

If You registered to receive Notifications to Your mobile device, the card management feature is available when You have Your mobile device within the operating range of a wireless carrier with an appropriate signal for data services. The card management feature is subject to transmission limitations and service interruptions. DPFCU does not guarantee that the card management feature (or any portion thereof) will be available at all times or in all areas.

You acknowledge and agree that certain functionality with the card management feature may not be available for all transactions. Commands based upon the location of the mobile device where the card management feature is installed or the location of the merchant where the card is being attempted for use may not apply appropriately to card-not-present transactions or transactions where the location of the actual location of the merchant differs from the merchant’s registered address.

You acknowledge and agree that neither DPFCU nor its third-party services providers (including the developer of the technology enabling the Notifications) are responsible for performance degradation, interruption or delays due to conditions outside of its control. You acknowledge that neither DPFCU nor its third-party service providers shall be liable to You if You are unable to receive Notifications on Your mobile device in Your intended area. DPFCU, for itself and its third-party service providers, disclaims all liability for: any delays, mis-delivery, loss, or failure in the delivery of any Notification; any form of active or passive filtering.

Linked Internet Sites

From time to time the Credit Union may place links to other websites on the Credit Union’s webpages. The Credit Union has no control over any other website and is not responsible for the content on any site other than this one. You should be aware that linked sites may contain rules and regulations, privacy provisions, confidentiality provisions, transmission of personal data provisions, and other provisions that differ from the provisions provided on our Site. We are not responsible for such provisions, and expressly disclaim any and all liability related to such provisions. Users assume all responsibility when they go to other sites via the links on this website.

Secure Area Access/Data Transmission

A user can only access secure areas of the Site with a valid password related to accounts held by the Credit Union. Because of the Site security system, should a user attempt to access a secure area more than five times using an invalid user ID or password, that user will be locked out of the secure areas of the Site. To regain access to the secure areas, user must contact Member Services at 330-364-8874.

Unauthorized individuals attempting to access secure areas of the Site may be subject to prosecution. To ensure information remains confidential, the Credit Union uses encryption technology, such as Secure Socket Layer (SSL), to protect information you enter and submit from our website.

Email Security

Regular Internet email is not secure. You should never provide information that is sensitive or confidential such as your social security number, account number, or PIN through unsecured email. We ask that you do not send personal or account information through regular email.

Violations of Rules and Regulations

We reserve the right to seek all remedies available at law and in equity for violations of these Terms and Conditions, including the right to block access from a particular Internet address to the Site.

Cookies

A cookie is a small piece of information that a website stores directly on the computer you are using. Cookies may contain a variety of information, from a simple count of how often you visit a website, to information which allows customization of a website for your use. The Credit Union uses cookies to gather data about the usage of our website and to ensure that you have access to your account information. Anytime a cookie is used, personal information is encrypted for our use only and is protected from third-party access (a cookie cannot be read by a website other than the one that sets the cookie).

Jurisdiction/Governing Law

This agreement and the use of this website are governed by the laws of the State of Ohio.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

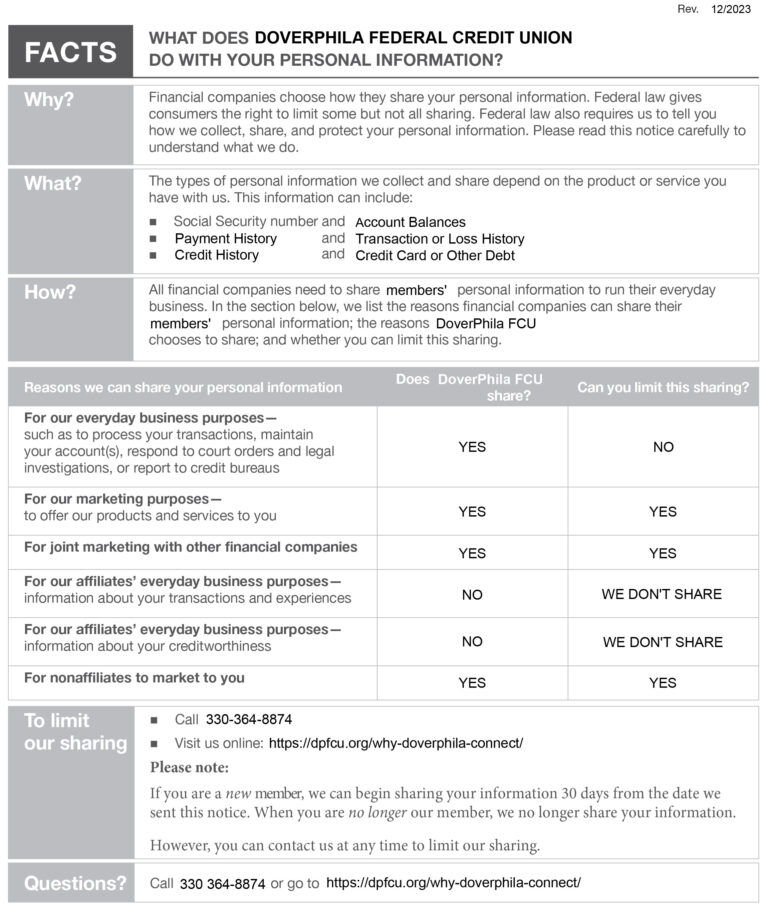

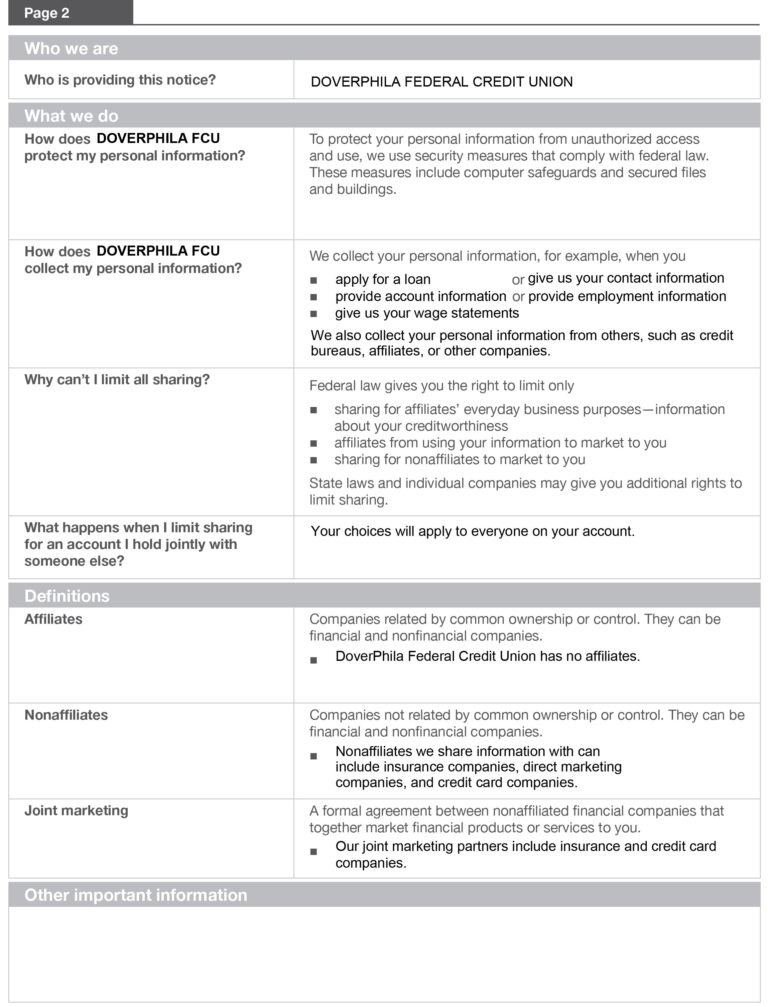

Privacy Policy

Click on the button below to review and download DoverPhila’s Privacy Policy.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

Website Privacy Policy

Our Online Privacy Practices

Keeping financial and personal information secure is one of our most important responsibilities. DoverPhila Federal Credit Union is committed to protecting the information of our members and other non-member visitors who use our website. We value your trust and handle all personal information with care.

As with information we collect through other means, we use the information you provide online to respond to your needs, service your accounts, and provide you services.

Secure Transmissions

To ensure information remains confidential, DoverPhila Federal Credit Union uses encryption technology such as Secure Socket Layer (SSL) to protect information you enter and submit from our website.

Email Security

Regular email is not secure. You should never provide information that is sensitive or confidential (such as your social security number, account number, or PIN) through unsecured email.

Cookies

A cookie is a small piece of information that a website stores directly on the computer you are using. Cookies may contain a variety of information from a simple count of how often you visit a website to information which allows customization of a website for your use. DoverPhila Federal Credit Union uses cookies to gather data about the usage of our website and to ensure that you have access to your account information. Anytime a cookie is used, personal information is encrypted for our use only and is protected from third party access (a cookie cannot be read by a website other than the one that sets the cookie).

Third Party Links

DoverPhila Federal Credit Union provides links to other organizations’ websites as a service to our members. DoverPhila Federal Credit Union does not control and is not responsible for the product, service, or overall website content available at a third-party site. DoverPhila Federal Credit Union neither endorses the information, content, presentation, or accuracy nor makes any warranty, express or implied, regarding any external site. DoverPhila Federal Credit Union does not represent either the third party or the member if the two enter into a transaction.

DoverPhila Federal Credit Union’s privacy policies do not apply to linked websites. You should consult the privacy disclosures on any linked site for further information, especially before providing any personal non-public information.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

- Mobile Privacy Policy

- Electronic Communication Policy

-

ESign Disclosure

DoverPhila Federal Credit Union Mobile Banking Privacy Policy

Last Updated: September 2023

DPFCU (the “App”) – powered by Fiserv – helps you control your credit and/or debit cards through your mobile device, making it easy to manage your finances on the go.

The App allows you to:

- Get real-time balances for your accounts

- Manage your money

- View your transactions and statements

- Make transfers

- Pay your bills and manage billers

- Deposit a check

- Receive alerts

- Manage cards

This Privacy Policy, in combination with other relevant privacy notices that we provide to you (e.g., pursuant to financial privacy laws), inform you of the policies and practices regarding the collection, use and disclosure of any personal information that we and our service providers collect from or about users in connection with the App’s website and mobile application (the “Services”).

THE TYPES OF INFORMATION WE COLLECT IN THE APP

Through your use of the Services, we may collect personal information from you in the following ways:

(a) Personal Information You Provide to Us.

- We may collect personal information from you, such as your first and last name, address, e-mail, telephone number, and social security number when you create an account.

- We will collect the financial and transaction information necessary to provide you with the Services, including account numbers, payment card expiration date, payment card identification, verification numbers, and transaction and payment history.

- If you provide feedback or contact us via email, we will collect your name and email address, as well as any other content included in the email, in order to send you a reply.

- We also collect other types of personal information that you provide voluntarily, such as any information requested by us if you contact us via email regarding support for the Services.

(b) Personal Information Collected from Third Parties. We may collect certain information from identity verification services and consumer reporting agencies, including credit bureaus, in order to provide some of our Services.

(c) Personal Information Collected Via Technology. We and our service providers may automatically log information about you, your computer or mobile device, and your interaction over time with our Services, our communications, and other online services, such as:

- Device data, such as your computer’s or mobile device’s operating system type and version, manufacturer and model, browser type, screen resolution, RAM and disk size, CPU usage, device type (e.g., phone, tablet), IP address, unique identifiers, language settings, mobile device carrier, radio/network information (e.g., Wi-Fi, LTE, 3G), and general location information such as city, state or geographic area.

- Online activity data, such as pages or screens you viewed, how long you spent on a page or screen, the website you visited before browsing to the Service, navigation paths between pages or screens, information about your activity on a page or screen, access times, and duration of access.

- Cookies, which are text files that websites store on a visitor’s device to uniquely identify the visitor’s browser or to store information or settings in the browser for the purpose of helping you navigate between pages efficiently, remembering your preferences, enabling functionality, and helping us understand user activity and patterns.

- Local storage technologies, like HTML5 and Flash, that provide cookie-equivalent functionality but can store larger amounts of data, including on your device outside of your browser in connection with specific applications.

- Web beacons, also known as pixel tags or clear GIFs, which are used to demonstrate that a web page or email was accessed or opened, or that certain content was viewed or clicked.

- Location Information. If you have enabled location services on your phone and agree to the collection of your location when prompted by the Services, we will collect location data when you use the Services even when the app is closed or not in use; for example, to provide our fraud detection services. If you do not want us to collect this information, you may decline the collection of your location when prompted or adjust the location services settings on your device.

HOW WE USE YOUR INFORMATION COLLECTED IN THE APP

(a) General Use. In general, we use your personal information collected through your use of the Services to respond to your requests as submitted through the Services, to provide you the Services you request, and to help serve you better. We use your personal information, in connection with the App, in the following ways:

- facilitate the creation of, and secure and maintain your account

- identify you as a legitimate user in our system

- provide improved administration of the Services

- provide the Services you request

- improve the quality of experience when you interact with the Services

- send you administrative e-mail notifications, such as security or support and maintenance advisories; and send surveys, offers, and other promotional materials related to the Services.

(b) Compliance and protection. We may use your personal information to:

- comply with applicable laws, lawful requests, and legal process, such as to respond to subpoenas or requests from government authorities

- protect our, your or others’ rights, privacy, safety, or property (including by making and defending legal claims)

- audit our internal processes for compliance with legal and contractual requirements and internal policies

- enforce the terms and conditions that govern the Service; and

- prevent, identify, investigate / deter fraudulent, harmful, unauthorized, unethical, or illegal activity, including cyberattacks and identity theft.

(c) Creation of Non-Identifiable Data. The App may create de-identified information records from personal information by excluding certain information (such as your name) that makes the information personally identifiable to you. We may use this information in a form that does not personally identify you to analyze request patterns and usage patterns to enhance our products and services. We reserve the right to use and disclose non-identifiable information to third parties in our discretion.

DISCLOSURE OF YOUR PERSONAL INFORMATION

We disclose your personal information collected through your use of the Services as described below.

(a) In Accordance with Our Other Privacy Notices. Other than as described in this Privacy Policy in connection with the App, this Privacy Policy does not apply to the processing of your information by us or third parties with whom we share information.

(b) Third Party Service Providers. We may share your personal information with third party or affiliated service providers that perform services for or on behalf of us in providing the App, for the purposes described in this Privacy Policy, including: to provide you with the Services; to conduct quality assurance testing; to facilitate the creation of accounts; to optimize the performance of the Services; to provide technical support; and/or to provide other services to the App.

(c) Authorities and Others. Regardless of any choices you make regarding your personal information, The App may disclose your personal information to law enforcement, government authorities, and private parties, for the compliance and protection services described above.

LINKS TO OTHER SITES

The App may contain links to third party websites. When you click on a link to any other website or location, you will leave the App and go to another site and another entity may collect personal and/or anonymous information from you. The App’s provision of a link to any other website or location is for your convenience and does not signify our endorsement of such other website or location or its contents. We have no control over, do not review, and cannot be responsible for, these outside websites or their content. Please be aware that the terms of this Privacy Policy do not apply to these outside websites. We encourage you to read the privacy policy of every website you visit.

YOUR CHOICES REGARDING YOUR INFORMATION

You have several choices regarding use of information on the Services.

(a) How We Respond to Do Not Track Signals. Some web browsers transmit “do not track” signals to the websites and other online services with which your web browser communicates. There is currently no standard that governs what, if anything, websites should do when they receive these signals. We currently do not act in response to these signals. If and when a standard is established, we may revise its policy on responding to these signals.

(b) Access, Update, or Correct Your Information. You can access, update, or correct your information by changing preferences in your account. For additional requests, please contact us.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

Download the DoverPhila Mobile Banking app by selecting one of the buttons below.

Electronic Communication Policy

By becoming a member of DoverPhila Federal Credit Union, you and all parties involved in the pre-qualification request agree to receive email, SMS, or other marketing communications from DoverPhila Federal Credit Union. DoverPhila Federal Credit Union may contact you via phone, text, or email at the provided contact or calling numbers, including your cellular number. You further understand that your telephone provider may impose charges on you for these contacts. You are not required to provide this consent to be effective, even if your contact or calling numbers or email address are on a do-not-call list. Your consent to receive calls is not necessary to make any purchases.

If you do not wish to receive marketing communications, contact DoverPhila Federal Credit Union at 330-364-8874.

For additional information, click and view the following documents:

DPFCU Account E-Sign Disclosure and Consent

The following disclosure is required by the federal Electronic Signatures in Global and National Commerce Act (E-SIGN Act). Please read this E-SIGN Disclosure carefully and keep a copy for your records.

Electronic Delivery of Disclosures and Notices

By signing this disclosure, you are consenting to receive disclosures related to your account(s) electronically. This includes, but is not limited to: statement copies, credit report copies, cleared check copies, signature cards, requests to release information, etc. If you do not consent; we will mail these documents to you. By consenting to electronic delivery of disclosures, you agree to provide us with your current email address and update us as to any changes in such information by contacting us at the numbers or email addresses listed on our website at www.dpfcu.org.

Requesting Paper Copies

Even after consent, you have the right to receive a paper copy of the disclosures related to your account(s). If you would like to receive a paper copy at no charge, please contact us at the numbers or email addresses listed on our website at www.dpfcu.org. Please include your name and mailing address and be sure to state that you are requesting a copy of the disclosures related to your account(s).

Withdrawal of Consent

You have the right to withdraw your consent to have a document or communication made available to you in electronic form at any time. There are currently no conditions, consequences or fees associated with you withdrawing your consent.

You may withdraw your consent to receive a document or communication electronically at any time. If you wish to do so, please notify us in writing to DPFCU at 129 Fillmore Avenue, Dover, OH 44622 or via email at feedback@dpfcu.org and provide your name, mailing address, daytime telephone number, and a description of the document or communication from which you are withdrawing your consent.

Scope of Your Consent

Your consent to use electronic signatures and to receive documents or communications electronically applies only to a document or communication pertaining to your enrollment in DPFCU On-Line-On Time (desktop and mobile app) and request for any services on this website including online account opening.

Hardware and Software Requirements

In order to access, view, and retain your account(s) information electronically, you must have:

- A personal computer or other device which is capable of accessing the Internet.

- An Internet web browser with capabilities to support a minimum of 128-bit encryption.

- Software which permits you to receive, access, and print Portable Document format or “PDF” files, such as Adobe Reader® version 8.0 and above.

- An active email address.

Changes to Hardware and/or Software Requirements

You will be notified of any changes to the hardware and/or software requirements that may create a material risk that you will not be able to receive, view, print or save a document or communication.

Your Consent to Use Electronic Signature and Electronic Delivery of Documents or Communications

- By opening an account online or signing up for edocuments through On-Line-On Time,

you consent to use your electronic signature to sign any document or communication and

to receive electronic delivery of any document or communication. You understand that

your electronic signature is legally binding, just as if you had signed a paper document. - If you do not Agree, you may not proceed to open an account online or sign up for

edocuments and you may visit a branch to open an account and no documents will be sent

to you electronically.

Termination/Changes

We reserve the right, in our sole discretion, to discontinue the provision of your account

information electronically, or to terminate or change the terms and conditions on which we

provide account information electronically. We will provide you with notice of any such

termination or change as required by law.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

- Home Banking Terms & Conditions

-

Privacy Policy

DoverPhila's Home Banking (Internet Banking) Terms & Conditions

DoverPhila Federal Credit Union (“Credit Union”) requires that all visitors to our website (the “Site”) adhere to the following terms and conditions. Accessing the site or viewing any of its content shall constitute your acknowledgement of and agreement with these terms and conditions. If you do not agree, please exit the Site at this time.

Website Content/Use of Information and Materials

This website has been established by the Credit Union for the sole purpose of conveying information about the Credit Union’s products and services and to allow communication between the Credit Union and its members. Information that appears on this website should be considered an advertisement. Nothing contained in any page on this Site takes the place of the Credit Union’s agreements and disclosures that govern its products and services. If any information on the Site conflicts with that in the Credit Union’s agreements and disclosures, the agreements and disclosures will control. Your eligibility for particular products and services is subject to our final determination and approval. The information and material contained on the Site and this agreement may be changed from time to time by posting the new Terms & Conditions on the website.

All users agree to be subject to this agreement as it changes from time to time.

Copyright/Trademarks

All information, including designs, content and images, contained on the Site is owned by DoverPhila Federal Credit Union or CUconnections and/or licensed to DoverPhila Federal Credit Union or CUconnections. All information and content including software programs available on or used to operate the Site (“Content”) is proprietary to the respective owners. Users are prohibited from modifying, copying, distributing, transmitting, displaying, publishing, selling, licensing, creating derivative works or using any of the Marks or Content available on or through the Site for commercial or public purposes.

No Warranties

The Credit Union makes no warranties of any kind regarding the products and services advertised on this Site. The Credit Union will use reasonable efforts to ensure that all information displayed is accurate; however, the Credit Union expressly disclaims any representation and warranty, express and implied, including, without limitation, warranties of merchantability, fitness for a particular purpose, suitability, and the ability to use the Site without contracting a computer virus. The Credit Union is not responsible for any loss, damage, expense, or penalty (either in tort, contract, or otherwise), including direct, indirect, consequential, and incidental damages, that result from the access of or use of this Site. This limitation includes, but is not limited to the omission of information, the failure of equipment, the delay or inability to receive or transmit information, the delay or inability to print information, the transmission of any computer virus, or the transmission of any other malicious or disabling code or procedure. This limitation applies even if the Credit Union has been informed of the possibility of such loss or damage.

Card Management

The card management feature is offered by DPFCU (referred to herein as “CardHub”, “us”, “we” or “our”) for use by DPFCU cardholders. DPFCU ’s card management feature is intended to allow You to initiate certain payment card related activities for Your enrolled DPFCU card(s) via the card management feature. Those activities may include the ability to but not limited to:

- Register the card

- Activate and deactivate the card

- Set control preferences for card usage including location, transaction, and merchant types, spend limits, and card on/off (“Controls”)

- Set alert preferences for card usage including location, transaction, and merchant types, spend limits, and declined purchases (“Alerts”)

- View transaction history including cleansed and enriched merchant information (e.g., merchant name, address, and contact information)

- Report Your card as lost or stolen

- Review Your spending by merchant type and/or by month

- View a list of merchants storing Your card information for recurring or card-on-file payments

The card management feature may enable access to DPFCU and third parties’ services and web sites, including GPS locator websites, such as Google. Use of such services may require internet access and that You accept additional terms and conditions applicable thereto, including, with respect to Google maps, those terms and conditions of use found at http://maps.google.com/help/terms_maps. Html and the Google Legal Notices found at https://www.google.com/help/legalnotices_maps/, or such other URLs as may be updated by Google. To the extent the card management feature allows You to access third party services, DPFCU and those third parties, as applicable, reserve the right to change, suspend, remove, limit, or disable access to any of those services at any time without notice and without liability to You.

You agree to allow us to communicate with You via push notification, SMS and/or email, with respect to the activities performed via the card management feature. Data fees may be imposed by Your mobile provider for the transmission and receipt of messages and Alerts.

DPFCU reserves the right to send administrative and service notifications via emails and/or SMS messages to the email address and/or phone number provided upon enrollment in DPFCU’s card management feature.

Availability/Interruption. You acknowledge that the actual time between occurrence of an event (“Event”) triggering a selected Control or Alert and the time the notification of such event is sent to Your mobile device (“Notification”) is dependent on a number of factors including, without limitation, Your wireless service and coverage within the area in which You are located at that time. You acknowledge that Notifications of Events may be delayed, experience delivery failures, or face other transmission problems. Similarly, selection of Controls and Alerts (collectively, “Commands”) are likewise affected by the same or similar factors and problems could arise with use of Commands. Notifications of Events may not be available to be sent to Your mobile device in all areas.

If You registered to receive Notifications to Your mobile device, the card management feature is available when You have Your mobile device within the operating range of a wireless carrier with an appropriate signal for data services. The card management feature is subject to transmission limitations and service interruptions. DPFCU does not guarantee that the card management feature (or any portion thereof) will be available at all times or in all areas.

You acknowledge and agree that certain functionality with the card management feature may not be available for all transactions. Commands based upon the location of the mobile device where the card management feature is installed or the location of the merchant where the card is being attempted for use may not apply appropriately to card-not-present transactions or transactions where the location of the actual location of the merchant differs from the merchant’s registered address.

You acknowledge and agree that neither DPFCU nor its third-party services providers (including the developer of the technology enabling the Notifications) are responsible for performance degradation, interruption or delays due to conditions outside of its control. You acknowledge that neither DPFCU nor its third-party service providers shall be liable to You if You are unable to receive Notifications on Your mobile device in Your intended area. DPFCU, for itself and its third-party service providers, disclaims all liability for: any delays, mis-delivery, loss, or failure in the delivery of any Notification; any form of active or passive filtering.

Linked Internet Sites

From time to time the Credit Union may place links to other websites on the Credit Union’s webpages. The Credit Union has no control over any other website and is not responsible for the content on any site other than this one. You should be aware that linked sites may contain rules and regulations, privacy provisions, confidentiality provisions, transmission of personal data provisions, and other provisions that differ from the provisions provided on our Site. We are not responsible for such provisions, and expressly disclaim any and all liability related to such provisions. Users assume all responsibility when they go to other sites via the links on this website.

Secure Area Access/Data Transmission

A user can only access secure areas of the Site with a valid password related to accounts held by the Credit Union. Because of the Site security system, should a user attempt to access a secure area more than five times using an invalid user ID or password, that user will be locked out of the secure areas of the Site. To regain access to the secure areas, user must contact Member Services at 330-364-8874.

Unauthorized individuals attempting to access secure areas of the Site may be subject to prosecution. To ensure information remains confidential, the Credit Union uses encryption technology, such as Secure Socket Layer (SSL), to protect information you enter and submit from our website.

Email Security

Regular Internet email is not secure. You should never provide information that is sensitive or confidential such as your social security number, account number, or PIN through unsecured email. We ask that you do not send personal or account information through regular email.

Violations of Rules and Regulations

We reserve the right to seek all remedies available at law and in equity for violations of these Terms and Conditions, including the right to block access from a particular Internet address to the Site.

Cookies

A cookie is a small piece of information that a website stores directly on the computer you are using. Cookies may contain a variety of information, from a simple count of how often you visit a website, to information which allows customization of a website for your use. The Credit Union uses cookies to gather data about the usage of our website and to ensure that you have access to your account information. Anytime a cookie is used, personal information is encrypted for our use only and is protected from third-party access (a cookie cannot be read by a website other than the one that sets the cookie).

Jurisdiction/Governing Law

This agreement and the use of this website are governed by the laws of the State of Ohio.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

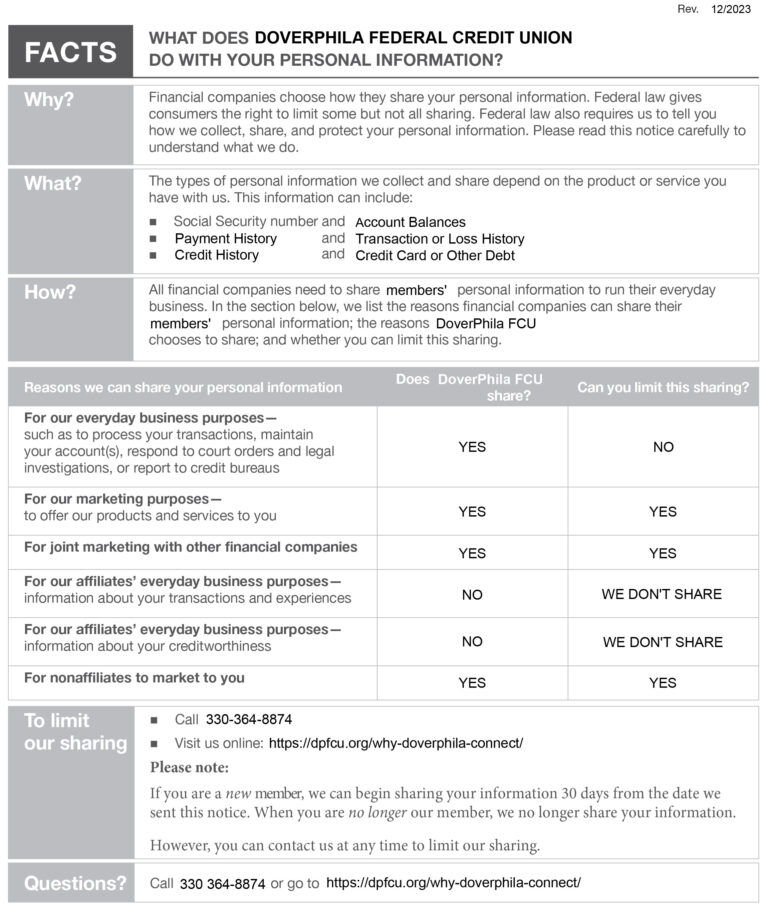

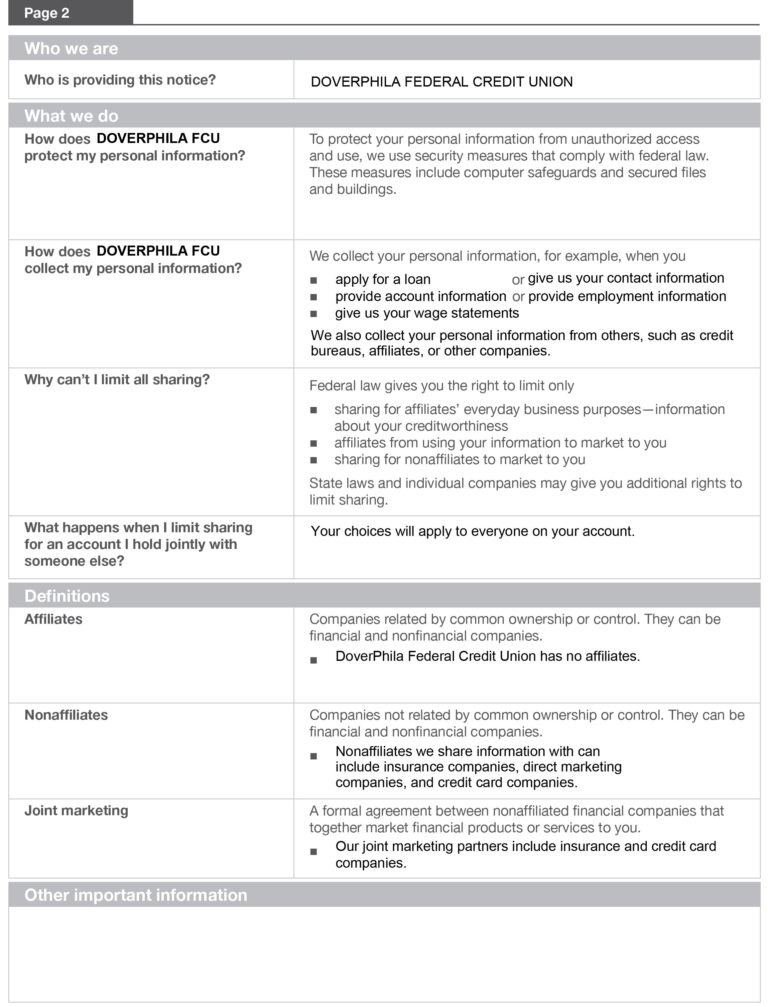

Privacy Policy

Click on the button below to review and download DoverPhila’s Privacy Policy.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

-

Website Privacy Policy

Website Privacy Policy - Mobile Privacy Policy

Website Privacy Policy

Our Online Privacy Practices

Keeping financial and personal information secure is one of our most important responsibilities. DoverPhila Federal Credit Union is committed to protecting the information of our members and other non-member visitors who use our website. We value your trust and handle all personal information with care.

As with information we collect through other means, we use the information you provide online to respond to your needs, service your accounts, and provide you services.

Secure Transmissions

To ensure information remains confidential, DoverPhila Federal Credit Union uses encryption technology such as Secure Socket Layer (SSL) to protect information you enter and submit from our website.

Email Security

Regular email is not secure. You should never provide information that is sensitive or confidential (such as your social security number, account number, or PIN) through unsecured email.

Cookies

A cookie is a small piece of information that a website stores directly on the computer you are using. Cookies may contain a variety of information from a simple count of how often you visit a website to information which allows customization of a website for your use. DoverPhila Federal Credit Union uses cookies to gather data about the usage of our website and to ensure that you have access to your account information. Anytime a cookie is used, personal information is encrypted for our use only and is protected from third party access (a cookie cannot be read by a website other than the one that sets the cookie).

Third Party Links

DoverPhila Federal Credit Union provides links to other organizations’ websites as a service to our members. DoverPhila Federal Credit Union does not control and is not responsible for the product, service, or overall website content available at a third-party site. DoverPhila Federal Credit Union neither endorses the information, content, presentation, or accuracy nor makes any warranty, express or implied, regarding any external site. DoverPhila Federal Credit Union does not represent either the third party or the member if the two enter into a transaction.

DoverPhila Federal Credit Union’s privacy policies do not apply to linked websites. You should consult the privacy disclosures on any linked site for further information, especially before providing any personal non-public information.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

DoverPhila Federal Credit Union Mobile Banking Privacy Policy

Last Updated: September 2023

DPFCU (the “App”) – powered by Fiserv – helps you control your credit and/or debit cards through your mobile device, making it easy to manage your finances on the go.

The App allows you to:

- Get real-time balances for your accounts

- Manage your money

- View your transactions and statements

- Make transfers

- Pay your bills and manage billers

- Deposit a check

- Receive alerts

- Manage cards

This Privacy Policy, in combination with other relevant privacy notices that we provide to you (e.g., pursuant to financial privacy laws), inform you of the policies and practices regarding the collection, use and disclosure of any personal information that we and our service providers collect from or about users in connection with the App’s website and mobile application (the “Services”).

THE TYPES OF INFORMATION WE COLLECT IN THE APP

Through your use of the Services, we may collect personal information from you in the following ways:

(a) Personal Information You Provide to Us.

- We may collect personal information from you, such as your first and last name, address, e-mail, telephone number, and social security number when you create an account.

- We will collect the financial and transaction information necessary to provide you with the Services, including account numbers, payment card expiration date, payment card identification, verification numbers, and transaction and payment history.

- If you provide feedback or contact us via email, we will collect your name and email address, as well as any other content included in the email, in order to send you a reply.

- We also collect other types of personal information that you provide voluntarily, such as any information requested by us if you contact us via email regarding support for the Services.

(b) Personal Information Collected from Third Parties. We may collect certain information from identity verification services and consumer reporting agencies, including credit bureaus, in order to provide some of our Services.

(c) Personal Information Collected Via Technology. We and our service providers may automatically log information about you, your computer or mobile device, and your interaction over time with our Services, our communications, and other online services, such as:

- Device data, such as your computer’s or mobile device’s operating system type and version, manufacturer and model, browser type, screen resolution, RAM and disk size, CPU usage, device type (e.g., phone, tablet), IP address, unique identifiers, language settings, mobile device carrier, radio/network information (e.g., Wi-Fi, LTE, 3G), and general location information such as city, state or geographic area.

- Online activity data, such as pages or screens you viewed, how long you spent on a page or screen, the website you visited before browsing to the Service, navigation paths between pages or screens, information about your activity on a page or screen, access times, and duration of access.

- Cookies, which are text files that websites store on a visitor’s device to uniquely identify the visitor’s browser or to store information or settings in the browser for the purpose of helping you navigate between pages efficiently, remembering your preferences, enabling functionality, and helping us understand user activity and patterns.

- Local storage technologies, like HTML5 and Flash, that provide cookie-equivalent functionality but can store larger amounts of data, including on your device outside of your browser in connection with specific applications.

- Web beacons, also known as pixel tags or clear GIFs, which are used to demonstrate that a web page or email was accessed or opened, or that certain content was viewed or clicked.

- Location Information. If you have enabled location services on your phone and agree to the collection of your location when prompted by the Services, we will collect location data when you use the Services even when the app is closed or not in use; for example, to provide our fraud detection services. If you do not want us to collect this information, you may decline the collection of your location when prompted or adjust the location services settings on your device.

HOW WE USE YOUR INFORMATION COLLECTED IN THE APP

(a) General Use. In general, we use your personal information collected through your use of the Services to respond to your requests as submitted through the Services, to provide you the Services you request, and to help serve you better. We use your personal information, in connection with the App, in the following ways:

- facilitate the creation of, and secure and maintain your account

- identify you as a legitimate user in our system

- provide improved administration of the Services

- provide the Services you request

- improve the quality of experience when you interact with the Services

- send you administrative e-mail notifications, such as security or support and maintenance advisories; and send surveys, offers, and other promotional materials related to the Services.

(b) Compliance and protection. We may use your personal information to:

- comply with applicable laws, lawful requests, and legal process, such as to respond to subpoenas or requests from government authorities

- protect our, your or others’ rights, privacy, safety, or property (including by making and defending legal claims)

- audit our internal processes for compliance with legal and contractual requirements and internal policies

- enforce the terms and conditions that govern the Service; and

- prevent, identify, investigate / deter fraudulent, harmful, unauthorized, unethical, or illegal activity, including cyberattacks and identity theft.

(c) Creation of Non-Identifiable Data. The App may create de-identified information records from personal information by excluding certain information (such as your name) that makes the information personally identifiable to you. We may use this information in a form that does not personally identify you to analyze request patterns and usage patterns to enhance our products and services. We reserve the right to use and disclose non-identifiable information to third parties in our discretion.

DISCLOSURE OF YOUR PERSONAL INFORMATION

We disclose your personal information collected through your use of the Services as described below.

(a) In Accordance with Our Other Privacy Notices. Other than as described in this Privacy Policy in connection with the App, this Privacy Policy does not apply to the processing of your information by us or third parties with whom we share information.

(b) Third Party Service Providers. We may share your personal information with third party or affiliated service providers that perform services for or on behalf of us in providing the App, for the purposes described in this Privacy Policy, including: to provide you with the Services; to conduct quality assurance testing; to facilitate the creation of accounts; to optimize the performance of the Services; to provide technical support; and/or to provide other services to the App.

(c) Authorities and Others. Regardless of any choices you make regarding your personal information, The App may disclose your personal information to law enforcement, government authorities, and private parties, for the compliance and protection services described above.

LINKS TO OTHER SITES

The App may contain links to third party websites. When you click on a link to any other website or location, you will leave the App and go to another site and another entity may collect personal and/or anonymous information from you. The App’s provision of a link to any other website or location is for your convenience and does not signify our endorsement of such other website or location or its contents. We have no control over, do not review, and cannot be responsible for, these outside websites or their content. Please be aware that the terms of this Privacy Policy do not apply to these outside websites. We encourage you to read the privacy policy of every website you visit.

YOUR CHOICES REGARDING YOUR INFORMATION

You have several choices regarding use of information on the Services.

(a) How We Respond to Do Not Track Signals. Some web browsers transmit “do not track” signals to the websites and other online services with which your web browser communicates. There is currently no standard that governs what, if anything, websites should do when they receive these signals. We currently do not act in response to these signals. If and when a standard is established, we may revise its policy on responding to these signals.

(b) Access, Update, or Correct Your Information. You can access, update, or correct your information by changing preferences in your account. For additional requests, please contact us.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.

Download the DoverPhila Mobile Banking app by selecting one of the buttons below.

- Communication Policy

-

ESign Disclosure

Electronic Communication Policy

By becoming a member of DoverPhila Federal Credit Union, you and all parties involved in the pre-qualification request agree to receive email, SMS, or other marketing communications from DoverPhila Federal Credit Union. DoverPhila Federal Credit Union may contact you via phone, text, or email at the provided contact or calling numbers, including your cellular number. You further understand that your telephone provider may impose charges on you for these contacts. You are not required to provide this consent to be effective, even if your contact or calling numbers or email address are on a do-not-call list. Your consent to receive calls is not necessary to make any purchases.

If you do not wish to receive marketing communications, contact DoverPhila Federal Credit Union at 330-364-8874.

For additional information, click and view the following documents:

DPFCU Account E-Sign Disclosure and Consent

The following disclosure is required by the federal Electronic Signatures in Global and National Commerce Act (E-SIGN Act). Please read this E-SIGN Disclosure carefully and keep a copy for your records.

Electronic Delivery of Disclosures and Notices

By signing this disclosure, you are consenting to receive disclosures related to your account(s) electronically. This includes, but is not limited to: statement copies, credit report copies, cleared check copies, signature cards, requests to release information, etc. If you do not consent; we will mail these documents to you. By consenting to electronic delivery of disclosures, you agree to provide us with your current email address and update us as to any changes in such information by contacting us at the numbers or email addresses listed on our website at www.dpfcu.org.

Requesting Paper Copies

Even after consent, you have the right to receive a paper copy of the disclosures related to your account(s). If you would like to receive a paper copy at no charge, please contact us at the numbers or email addresses listed on our website at www.dpfcu.org. Please include your name and mailing address and be sure to state that you are requesting a copy of the disclosures related to your account(s).

Withdrawal of Consent

You have the right to withdraw your consent to have a document or communication made available to you in electronic form at any time. There are currently no conditions, consequences or fees associated with you withdrawing your consent.

You may withdraw your consent to receive a document or communication electronically at any time. If you wish to do so, please notify us in writing to DPFCU at 129 Fillmore Avenue, Dover, OH 44622 or via email at feedback@dpfcu.org and provide your name, mailing address, daytime telephone number, and a description of the document or communication from which you are withdrawing your consent.

Scope of Your Consent

Your consent to use electronic signatures and to receive documents or communications electronically applies only to a document or communication pertaining to your enrollment in DPFCU On-Line-On Time (desktop and mobile app) and request for any services on this website including online account opening.

Hardware and Software Requirements

In order to access, view, and retain your account(s) information electronically, you must have:

- A personal computer or other device which is capable of accessing the Internet.

- An Internet web browser with capabilities to support a minimum of 128-bit encryption.

- Software which permits you to receive, access, and print Portable Document format or “PDF” files, such as Adobe Reader® version 8.0 and above.

- An active email address.

Changes to Hardware and/or Software Requirements

You will be notified of any changes to the hardware and/or software requirements that may create a material risk that you will not be able to receive, view, print or save a document or communication.

Your Consent to Use Electronic Signature and Electronic Delivery of Documents or Communications

- By opening an account online or signing up for edocuments through On-Line-On Time,

you consent to use your electronic signature to sign any document or communication and

to receive electronic delivery of any document or communication. You understand that

your electronic signature is legally binding, just as if you had signed a paper document. - If you do not Agree, you may not proceed to open an account online or sign up for

edocuments and you may visit a branch to open an account and no documents will be sent

to you electronically.

Termination/Changes

We reserve the right, in our sole discretion, to discontinue the provision of your account

information electronically, or to terminate or change the terms and conditions on which we

provide account information electronically. We will provide you with notice of any such

termination or change as required by law.

Please contact DoverPhila Federal Credit Union by calling 330-364-8874 if you have questions or concerns.